News | PSR UCLA Students Conduct Research on Financing California’s Crumbling Infrastructure

Stop the VideoNews

PSR METRANS UTC

PSR UCLA Students Conduct Research on Financing California’s Crumbling Infrastructure

Tuesday, December 5, 2017

by By Karina Schneider, UCLA MURP 2019

Financing has become an increasing challenge for California infrastructure, and a group of recent graduates from the University of California, Los Angeles (UCLA) Anderson School of Management and UCLA Luskin School of Public Affairs addressed it in their recent research, “California Infrastructure Financing Alternatives,” an insightful project on financing alternatives, soon to be published by their university.[1] Currently, the costs of California’s much-needed infrastructure improvements far outweigh state funding capacity. Instead of relying on insufficient tax revenue and costly bond usage, the students suggested an alternate approach: engagement with the private sector.

Public-private partnerships (P3s or PPPs) typically involve a private entity financing, constructing, or managing a project in return for a promised stream of payments directly from government or indirectly from users of the project.[2] The students’ research indicated that P3s could be a more sustainable financing alternative, particularly for projects that require a large amount of capital, have a clear revenue stream, and have a cash-flow horizon of at least 25 years.

David Leipziger, one of the graduate student researchers, stated, “The P3 option is not always the right approach; however, the main value lies in risk sharing. The public sector pays a small premium for shedding substantial risk that a project might go awry.” P3 involvement in design-build-finance-operate-and-maintain (DBFOM) infrastructure involves a higher cost of capital, but can produce even greater benefits. “Building together multiple components of projects and relying on private sector financial and technical expertise can reduce life-cycle cost and completion time,” he added.

The students presented research and case studies from around the world where private participation significantly improved project delivery. For example, a 2003 UK National Audit Office study found that 98.6% of all P3 projects were delivered on time and 95% on budget, compared with 74.1% and 82% for traditionally-funded projects. During their interviews with industry experts, the students heard a number of P3 success stories. “At the policy level, for example, Canada boasts robust P3 frameworks at the state and provincial levels,” Leipziger noted. “At the project level, a project in Pennsylvania used a P3 to bundle together repair and maintenance of the state's road bridges; the contract reduced the cost to government by an estimated $1 million per bridge!”

Although there are clear benefits to private sector engagement, there are barriers facing P3s in California, such as the perception that P3s result in a privatization of public assets. “Part of the perception problem derives from poorly-informed local governments. Policymakers either eschew P3s on principles, or enter into ill-advised contracts that go awry and serve to further undermine the reputation of P3s,” said Leipziger. To address P3 concerns and misperceptions, the student researchers proposed a number of strategies.

One of the key strategies the students recommended was to establish an independent central agency to standardize the contract process and build public institutional knowledge of P3 procurement and management. Other strategies include forming a board of advisors from both the public and private sectors, using data in political advocacy, and speaking the right language to concerned constituents and stakeholders. With these strategies in place, the students are hopeful that P3s can be effectively utilized to finance California’s infrastructure projects.

Click here to download the research paper.

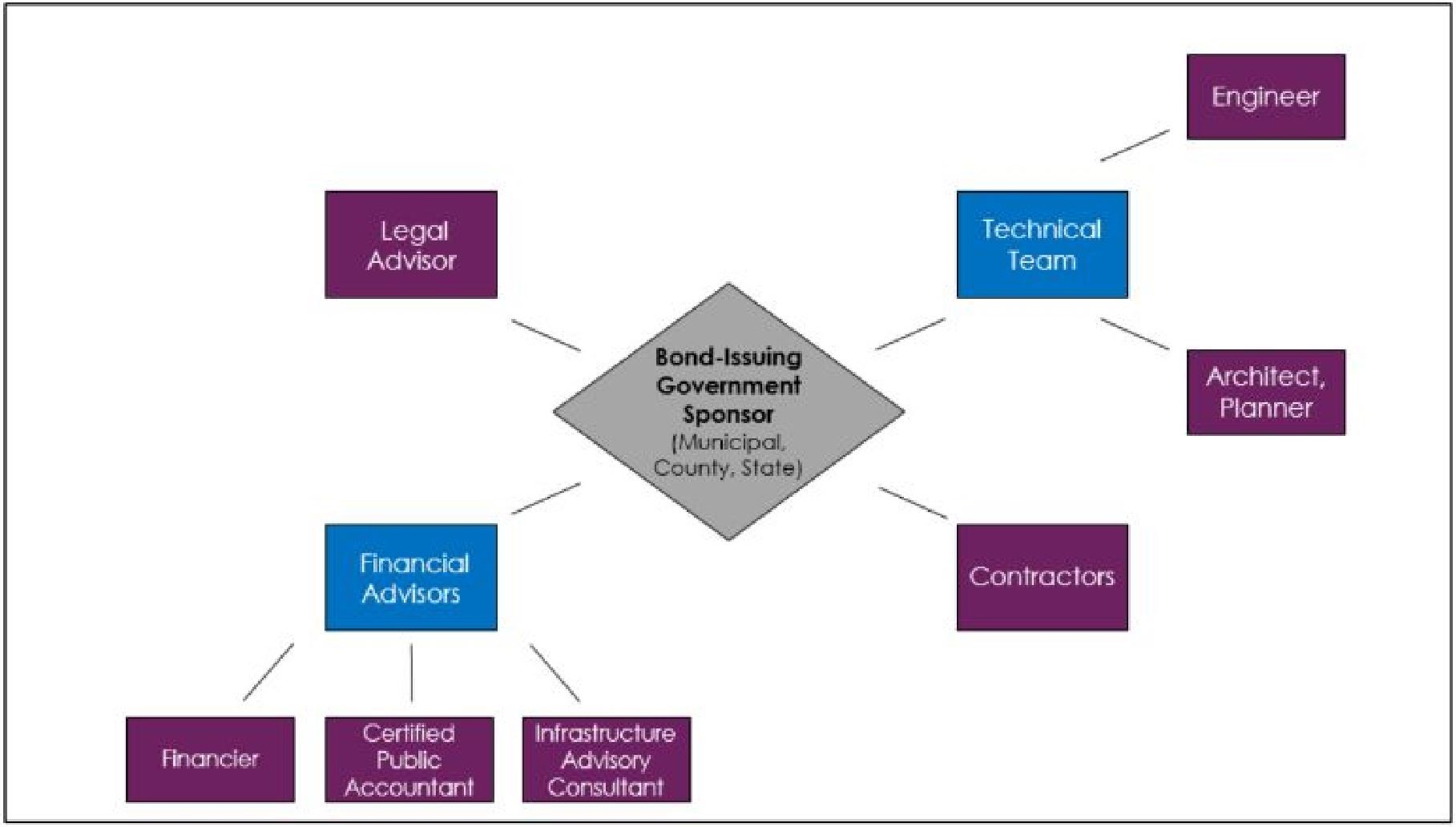

Infrastructure Procurement Stakeholder Map.

With the myriad of stakeholders involved in large infrastructure projects, public-private partnerships can better distribute risk and improve project delivery.

About the author: Karina Schneider

Karina Schneider is a first year Master's student in Urban and Regional Planning at UCLA. She is interested in transportation policy and planning, particularly in public transit and active transportation. She can be reached at kschneider2@g.ucla.edu.

[1] Dilawari, Leipziger, Rimal, and Ulloa. “California Infrastructure Financing Alternatives.” 2017.

News Archive

- December (1)

- November (6)

- October (4)

- September (1)

- August (3)

- July (4)

- June (3)

- May (7)

- April (8)

- March (10)

- February (8)

- January (7)

- December (7)

- November (8)

- October (11)

- September (11)

- August (4)

- July (10)

- June (9)

- May (2)

- April (12)

- March (8)

- February (7)

- January (11)

- December (11)

- November (5)

- October (16)

- September (7)

- August (5)

- July (13)

- June (5)

- May (5)

- April (7)

- March (5)

- February (3)

- January (4)

- December (4)

- November (5)

- October (5)

- September (4)

- August (4)

- July (6)

- June (8)

- May (4)

- April (6)

- March (6)

- February (7)

- January (7)

- December (8)

- November (8)

- October (8)

- September (15)

- August (5)

- July (6)

- June (7)

- May (5)

- April (8)

- March (7)

- February (10)

- January (12)